INVESTIGATION… ‘Official’ thugs killing small businesses in Cross River despite govt’s tax exemption policy

Amid the COVID-19 pandemic, small businesses, hawkers, and local intra-state transport operators in Cross River State are faced with illegal and multiple taxation. When there is resistance, illegal tax agents and thugs use force, intimidation, harassment, and threats to compel them to pay unregulated fees.

Recently, the state government officially announced a tax exemption policy for such small businesses. But despite this, cases of illegal and multiple taxation with the use of thugs are still recorded every day across the state. Patrick Egwu and Vivian Chime investigated to report why the illegal taxations were still going on despite the exemption policy.

.

Every morning, Life Okon Willy wakes up and gets ready to start the day. Willy, 42, is a tricycle rider who depends on his local intra-state transportation business to provide for his wife and five children. Before 7a.m., he leaves his home which lies at the outskirts of Calabar to begin his business for the day.

Because of the coronavirus pandemic which has disrupted businesses and other socio-economic and commercial activities, Willy makes between N2,000 and N3,000 at the end of the day. Making this paltry sum does not come easy.

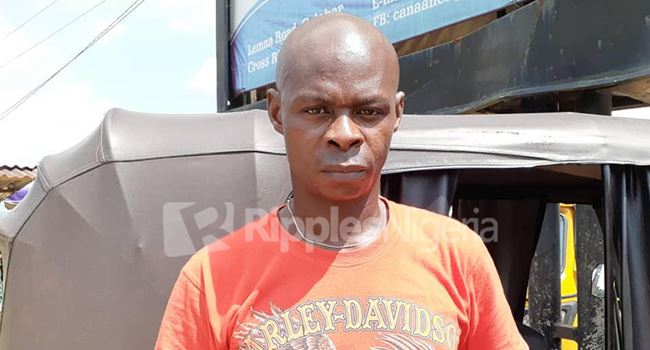

Okon Willy, a tricycle operator hardly takes home anything after paying the illegal tax

At the tricycle park in the city, Willy waits for more than one hour before it gets to his turn to pick up passengers in his 4-seater tricycle. But most of this money goes into paying illegal taxes and levies to thugs who always threaten to confiscate his tricycle if he decides not to pay. This is a daily occurrence.

“This is what I use to feed my family, pay house rents and send the children to school,” Willy said. “We use this and take care of ourselves too but in this condition, it becomes difficult for us.”

Despite the harsh economic realities caused by the pandemic, Willy says illegal tax agents alongside thugs still ask them to pay tax and levies. Every week, he pays more than N500 while in a month, he pays N2,000 or N2,500. After each payment, no official receipt is issued as evidence.

Over the radio, Willy said he heard a public announcement about the tax exemption policy, but was surprised that they were still forced and intimidated to pay tax. If anyone refuses to pay, their tricycle could be seized and they would be made to pay N20,000 or more before getting it back.

Okon Willy speaking on the illegal tax collection in the state and how they’re intimidated by thugs

“We pay N100 every day and they normally come at 5p.m. to ask us to pay again,” he tells Ripples Nigeria. “The pandemic has affected my business to the extent that I hardly see passengers because people are at home. If things were as they were before, we won’t be complaining but now we hardly see people around.”

On May 21, Governor Ben Ayade of Cross River state officially announced that some categories of businesses would be exempted from paying tax to the government in line with the state’s anti-tax law which was signed in 2015. Small businesses, hawkers and intra-state transport operators like Willy were exempted too.

Ayade inaugurated an anti-tax agency and said the exemption policy was part of his post-COVID-19 response to economic activities in the state.

“We implore you to know that your responsibility from today going forward is to put an end to illegal taxes on people,” an emotional Ayade said during the inauguration of the anti-tax agency. “We have a tax law here that prescribes those who are exempted from tax. All those categories of people and those from time to time may be so announced by the governor, including every single hotel that has less than 50 rooms in Calabar and in the whole state, today are exempted from payment of tax.”

Joy Francis, forced by illegal tax agents to pay tax daily

He continued: “We have exempted all okada riders [commercial motorcycles], taxi drivers, airport taxi drivers, small saloon owners, small catering and restaurant points, mama puts, eatery points. All those small, basic survival people, selling of produce, struggling to eke a living, have been exempted from paying tax. We have exempted them because it is better for me as a governor that I would rather task my brain than to tax my people.”

In 2017, Ayade had made this same announcement of exempting small businesses, poor and low-income earners from paying tax but sadly, there was no enforcement and the payment continued. This time around, he seems to be matching his words with action by setting up an anti-tax agency to enforce the new government policy.

However, cases of illegal taxation by agents and thugs are still on the increase among small business owners. Sometimes, the petty traders and hawkers who rely on their businesses for survival, are extorted and intimidated to pay these illegal fees.

Joy Francis says she scared of illegal tax agents who compel her to pay tax everyday

A new report about poverty and inequality in the country from September 2018 to October 2019 by the National Bureau of Statistics (NBS), said 40 percent of people in the continent’s most populous country lived below its poverty line of 137,430 naira ($381.75) a year. This represents 82.9 million people. The report was based on data from the Nigerian Living Standards Survey [NLSS] conducted between 2018 and 2019 in collaboration with World Bank’s Poverty Global Practice. The NLSS is the basis for measuring poverty and living standards in the country and is used to estimate a wide range of socio-economic indicators including benchmarking of the Sustainable Development Goals.

Nigeria is the most populous country on the continent with over 200 million population based on Worldometerelaboration of the latest United Nations data. Willy and his family are part of millions of Nigerians who find it difficult to survive under the prevailing economic conditions in the country. The situation might be worse if current trends continue with the United Nations estimating that Nigeria will have a population of 400 million by 2050.

Intimidation, harassment, and threats continue unabated

Ema Akpan the fish seller complains of illegal tax they are forced to pay, despite government’s exemption policy

Willy is not alone. Across the state, residents who run small businesses or hawk at local markets are facing the same illegal taxation and extortion by illegally commissioned agents. When they show resistance to pay, they are threatened or harassed by local thugs who work with the illegal tax agents. Women and other petty traders in the market who depend on daily sales to feed their families and pay other utility bills are always at the receiving end of such harsh treatments.

Grace Michael has a point at Watt market in Calabar where she sells vegetables. While her category of business was exempted from paying tax in the state, Grace says she still pays tax to illegal agents. When this continued and she could not cope anymore, Grace, 40, abandoned her restaurant and started hawking on the street to escape the illegal tax agents. Yet, she was still accosted on the street to pay tax.

“I pay for ticket every day,” she says, looking sombre. “Even yesterday, someone came here to collect money from me and if you resist, they will start beating you up and harassing you.”

Grace has four children whom she provides for with her hawking proceeds. But the illegal taxation is affecting her negatively and she is considering abandoning the business.

“I use whatever I make here to provide for my children, especially their education. But it has not been easy because of the regular taxation from these people [tax agents]. I just paid N200 some hours ago and another person came to collect the same amount again. And there is no money because business is not moving well because of coronavirus.”

Every market day, Grace pays about N1,000 or more to different groups of tax agents and thugs. They come around 4 p.m., when customers often come to the market to purchase from the traders. Sometimes, the hawkers earn less than N4,000 a day but will be forced to pay a large percent of the money as tax and levies.

“Two of my children are in the university and I have not paid their school fees before the coronavirus lockdown started. I was hoping to make some sales and raise some money before they resume but that is becoming unlikely with the way things are going,” she says.

Some years ago, Christian Usen-Etem, 18, lost his father. To support his mother, two siblings, and pay for his school fees, he cultivates and hawks vegetables in the market every day.

Ema Akpan, a fish seller complaining of illegal tax they pay despite the exemption policy

“When they [illegal tax agents] come, we normally tell them that they [government] say we should not pay any money, but they would insist and harass us to pay,” he tells Ripples Nigeria, looking anxious. “Those inside the market take N100 from us. In a week, I pay about N500 to them so they can allow me do my business.”

Just like Usen-Etem, Elijah Effiong Uduk hawks in the market to support his family. As he spoke with Ripples Nigeria, his eyes pranced from one direction to the other to make sure the thugs were not coming. Uduk, 13, says he fears whenever he remembers the illegal tax agents who often come to harass and intimidate them at the market.

“I heard government asked them to stop collecting the tax, but they are still forcing us to pay,” he says. “If you don’t pay, they would throw away your wares on the ground or they will come with their thugs to harass you.”

Uduk tells Ripples Nigeria that his mother also sells in the market. Some weeks ago, when the tax agents came to collect money from her, she resisted but was beaten and her wares were thrown away.

“About six different people come to collect money from us every day and if you sum it up, it would be about N1,200 every week that we pay,” he says.

“The biggest challenge with the tax regime in the state is the issue of multiplicity and duplicity in the number of taxes,” Ken Asim, a tax expert and secretary of the Calabar Chamber of Commerce tells Ripples Nigeria. “And then there is a considerable high rate of illegal tax collections. That is the problem here.”

Asim says there has been an introduction of several taxes, levies, and fees since 2019 that have been affecting small businesses.

A 2019 study published on the Journal of Taxation and Economic Development show that illegal and multiple taxes have negatively affected the growth of Small and Medium Enterprises [SMEs] in Nigeria as many operators of these businesses are unwilling to venture into new enterprises or expand the existing ones for fear of illegal and multiple taxes that continue to take a significant portion of their earnings.

Politicians behind illegal tax collection

One of the markets in Cross River

Ripples Nigeria investigation shows that some politicians in the state are behind the collection of illegal taxes on those categories of small businesses exempted from paying tax by the government. They organize a group of illegal tax collectors and thugs to move across the state harassing, intimidating, and using force to collect taxes and levies from small businesses, hawkers in the market and tricycle riders like Willy.

Further investigations for instance, show that the newly elected council chairmen who were inaugurated in June, want to meet with the governor to review the exemption policy which prohibits them from collecting tax or revenue in their areas.

“We know that politicians are behind some of this tax collection,” said Peter Odey, the leader of the House of Assembly in the state. “They call it revenue bond and we even know some of their boys that are involved. If you spot them, bring them [to the House of Assembly]. We will publicly shame them so that people in the state will know those involved in it.”

Every week, Willy is expected to remit N20,000 to the owner of the tricycle which he rides under a hire purchase agreement. Under the agreement, he will pay the owner of the tricycle N1,300,000 for a duration of one year and three months. After this time, Willy will take ownership of the tricycle. But this is becoming an uphill task for him as he is unable to meet the target largely due to the disruptions in movement caused by the pandemic and the multiple taxes and levies, he pays every day to the illegal agents and thugs who work for politicians. Willy tells Ripples Nigeria that he has operated the tricycle for less than four months and sometimes, he remits the whole money he makes for the week to the tricycle owner and goes home back to his family with nothing.

Earlier during the inauguration, Ayade

At the bustling Watt market, a 6-foot, dark-complexioned man stood by the busy roadside. Ripples Nigeria captured the moment he approached a teenage hawker and asked her to pay some money as tax. The girl opened her folded palms and handed him some money. After collecting it, he left her and approached another hawker who stood few meters away.

The state government has made some moves to clamp down on illegal tax agents who continue to collect tax on specified categories of businesses despite the exemption policy.

In a recent clampdown, the governor suspended the Commercial Transport Regulatory Agency [CTRA] for collecting tax despite the exemption. The CTRA which is notorious for violence in its approach, was found to be engaged in selling tickets to bus, taxi, and tricycle riders in the state. Additionally, the governor directed security agents to arrest anyone found to be collecting money from those exempted from paying tax in the state.

But this was just one out of many cases of companies or agents still engaged in collecting illegal tax from those exempted. However, no politician has been indicted in the illegal tax collection.

“When the government gives a directive, you see appointed officials going against it,” Asim said. “You find out that local government agents go about collecting a lot of taxes they are not entitled to collecting. This has created an unfriendly environment for most taxpayers. That is why you see a high rate of resistance to tax authorities from these taxpayers because a lot of these levies and fees are illegal.”

‘Anti-tax agency with no legal backing’

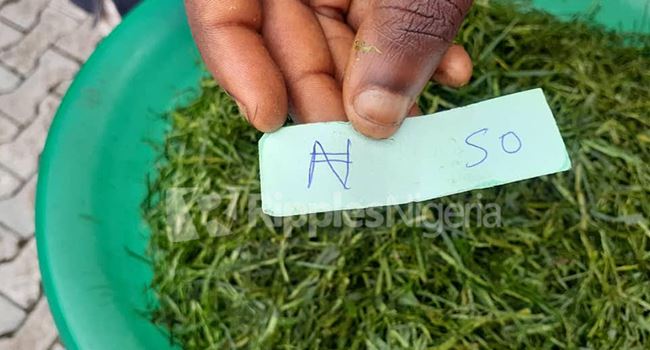

A seller displays the ticket from one of the illegal tax agents

The newly inaugurated anti-tax agency has not fully started functioning to enforce the ban on illegal and multiple tax collection in the state. For most part, they are seeking legislative backing and amendment of the state’s anti-tax law to empower and enable them perform their duties. This might be long in coming with bureaucratic procedures they have to pass.

“This is a very crucial meeting,” Emma Isong, the chairman of the anti-tax agency tells Ripples Nigeria during consultation with legislators. “In undertaking government functions and executing important policies, you take into cognizance relevant laws and legislations that give you the necessary teeth to bite and without the House of Assembly which performs for that, it would not be possible.”

Since their inauguration about two months ago, the agency has been mobilizing for support from lawmakers, organizing town hall meetings and creating awareness on their mandate across the state. Also, they have appointed representatives in the 18 local government council of the state and established a group known as the anti-tax brigade which will help in enforcing the exemption policy.

“Illegal taxations, multiple taxations and illegal road-blocks have been the bane of economic development in the state,” Isong says. “Some of you here have been victims of these illegal practices; so, for us right now, this is one of the best government policies that the governor has brought out since his five years of his administration.”

Isong claims the tax exemption policy is the first in the country and across the continent, adding that “the state has again taken the lead in the area of tax exemptions and tax holidays which seek to protect small businesses from shylock companies and consultants which has oppressed them hitherto.”

One of the thugs captured harassing and intimidating hawkers to collect tax at the market

Isong further says a mobile court will be created to prosecute offenders found guilty of collecting illegal taxes and levies on small businesses.

“Now government has again said they are exempting people from taxes and yet we still haven’t seen any regulations guiding how that is going to be implemented,” Asim said.

There are also concerns about the poor implementation of the state’s anti-tax law since it was passed. Experts believe it has not been fully implemented to end the practice of illegal taxation.

“When you bring a law into effect, the next thing you are supposed to do is to actually bring out a regulation on how you intend to implement that law,” Asim adds.

“For example, the tax exemption law clearly stipulates that at the beginning of every year, the governor will place before the House of Assembly the category of persons that are meant to be exempted from paying taxes. But we have seen that there have been no regulations guiding implementation of that law so that law has not been implemented up till now. That procedure has not been followed in any way.”

However, Isong is optimistic and has hopes of reforming illegal and multiple taxation in the state through their mandate.

“If we succeed in anti-tax policies, prices of goods and services will fall, and the economy will improve. That’s the basic calculation of the governor.”

How this will be achieved is still in doubt with the collusion of public officials who empower illegal agents and thugs for the collection of taxes and levies in the state.

Coping without tax

A young seller, another victim of the illegal tax agents in Cross River state

With most states depending on taxation to augment their Internally Generated Revenue, there are concerns on how the state will cope with the exemption of small businesses from paying tax which amounts to about 10 percent of collectable taxes.

Asim says another component of the exemption law is that for those categories of persons that have been exempted, the state Internal Revenue Service is meant to calculate what liabilities of those persons are and the state government will pay those taxes on behalf of the people.

“If we say that every small-scale farmer should not pay taxes, then we are talking about 70 percent of our farming population,” he says. “So the implication is that government is going to carry the entire tax burden of the state and place it on medium and large scale businesses because whatever they are not collecting from these businesses, they are likely going to face the larger organizations to pay for those. So, it is not a total exemption or a total loss of revenue for the government.”

Asim says the tax exemption is usually a short-term policy action by the government.

“It’s normally the kind of policies you put in place temporarily to cushion effect of certain economic hardships like we find ourselves right now; so it’s a strategy that can work for us right now but once we can get out of the COVID-19 and exit the post-economic downturn, I do not see government sustaining this policy.”

Willy and others like him who run small businesses or hawk at the local markets in the state feel the tax exemption policy made official by the government is a Greek gift. Apart from finding it hard to pull through during this pandemic, they still face additional burden of illegal taxation by multiple tax agents and thugs who harass and threaten them to pay.

“The number of taxes, levies and fees that each individual or business is paying already is too much and that is why we have been calling on governments to do a clear tax reform in the state,” Asim says. “Some are punitive while some are clearly impinging on the success and viability of businesses. When the taxes become too much, businesses are forced to leave and move to places with favourable business environments.”

Two weeks ago, the illegal tax agents and thugs visited a tricycle park where in the city Willy and others were waiting for passengers. They intimidated and forced them to pay the daily tax or else their tricycles would be seized.

“We pleaded with them, but they refused and insisted we must pay or else they won’t allow us to work for the day,” Willy said. “When we wanted to resist them, the thugs they came with moved to beat us, so we had to pay because we did not want them to take our tricycles. If they take it, we will pay extra money to collect it from them.”