RipplesMetrics… Every month Nigeria will pay N68.5 billion for due external debt in 2021

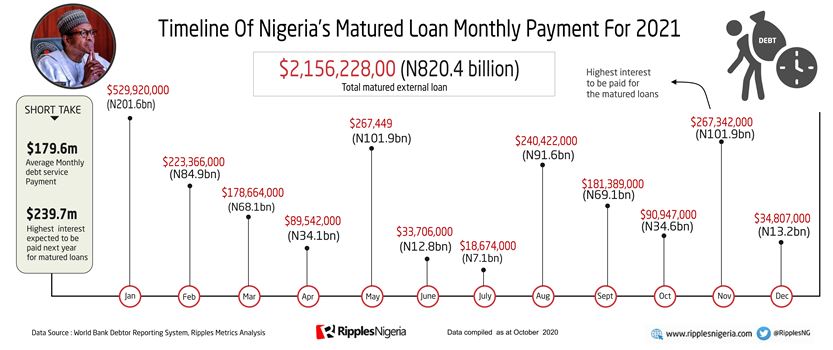

As the Nigerian government ponders over where to borrow its next loan, in few weeks, another round of external debt repayment for matured loans put at $2,156,228,000 (N822bn) will begin.

The matured loans repayment scheduled from January to December 2021 will cost the country average monthly pay of $179,686,000(N68.4 billion). This is according to figures published in the World Bank Debtor Reporting System.

January represents the most burden, as Nigeria will be obligated to pay out $529,920,000 (N202bn) to 10 levels of creditors’ type classified under multilateral, bilateral and bonds agreements.

A breakdown of the total amount expected to be paid from the three types of creditors is highlighted hereunder:

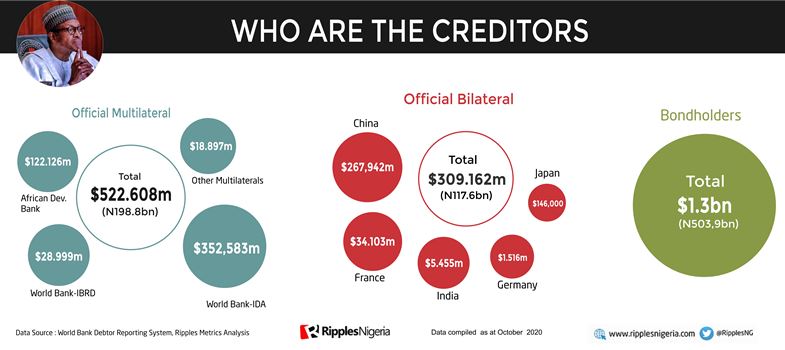

Nigeria will pay a total sum of $309.162m under bilateral agreement loans to five countries.

China will get the highest payment of $267,942m, followed by France, $34.103m; India will receive, $5.455m; Germany, $1.516m; and Japan, $146,000.

Under debts incurred through Multilateral agreement loans, a total of $522.608m will be paid to African Development Bank; $122.126m, World Bank IDA; $352,583m; World Bank-IBRD, $28.999m and all other Multilaterals will get $18.897m.

A sizable chunk of the due debt payments will be made to bondholders, $1.3bn, that is over N50 billion.

The debt obligations will not represent the biggest headache for President Muhammdu Buhari. The major worry is how Nigeria will meet these debts obligations due to piling interest rates.

The Central Bank of Nigeria (CBN), in its half-year 2020 economic report, indicates that the country is in a precarious liquidity position and its solvency ratio is becoming unsustainable. What this means is Nigeria might default on its debt obligations.

This is worrisome given that the large chunk of the debt payments are made up of accumulated interests and defaulting could mean extra burden.

Breakdown of the debts shows Nigeria’s actual principal is $1.2 billion – the money that you originally agreed to pay back- while interest payment is $1.07 billion.

The CBN, in its economic report had decried the interest payment of N1.15tn in the first half of 2020 for domestic and external debts obligations.

A long held agreed economics theory states that rising debt as a share of the economy would drive up the amount of money governments must pay in interest to borrowers.

Read also: RipplesMetrics… SARS TO SWAT: Change will cost Nigeria millions

Over the years, servicing accumulated debts have come as a serious burden. Nigeria spent ₦943bn in 2015, ₦1.36trn in 2016 and ₦1.66trn in 2017.

Similarly, in 2018, the Federal Government (FG) spent ₦2.23trn on debt servicing while in 2019, it spent ₦2.14trn.

Hence, in Nigeria’s quest to offset its debts, the country has had to borrow even more.

Already, in 2021, Nigeria has earmarked ₦4.28 trillion as a loan to be borrowed.

More and More Borrowing

Ripples Nigeria had reported the federal government was seeking approval from the National Assembly for $1.2 billion loan from Brazil to “revitalise Agriculture” through “The Green Imperative”.

Another $750 million loan facility is also requested to the World Bank which the federal government said is to ramp up the economies of states and improve the quality of lives of the vulnerable.

During the COVID-19 pandemic, the CBN economic report shows “the larger proportion of FGN revenue was devoted to debt service, instead of the socio economic needs of Nigerians”

The last five years have seen Nigeria’s debt increase by 158.33 percent from N12.1 trillion in 2015 to N31 trillion by June 30, 2020. And, the latest rounds of loans from Brazil and the World Bank will push Nigeria’s debt burden past N32 trillion.

Minister of finance, budget, and national planning, Dr Zainab Ahmed has consistently defended the level of borrowing, noting that time will justify the Buhari-led government on the growing debt.

But from all indications, it will take a miracle for this to be actualized, with a dwindling oil market from which a large chunk of Nigeria’s revenue is relied on.

The CBN report further revealed that Nigeria’s debt-to-GDP ratio is currently 19.2 per cent, a level that could seriously affect the growth objectives indicated in Economic Sustainability Plan (ESP) launched by the federal government.

Although Nigeria’s debt-to-GDP ratio is still far off the 40 percent debt limits by IMF for developing countries, the pace at which Nigeria is borrowing is coming at a huge cost.

“Nigeria will continue to fund its debt against the critical socio-economic needs of the population,” CBN warned.

AUTHOR: Dave Ibemere…